Power Purchase Agreement

PPA

Power Purchase Agreements (PPAs) are an instrument to market your production or consumption. The combination of a profile and the guarantees of origin (GOs) leads to a clear ‘line of sight’ for retailers from which asset your renewable power comes from. For renewable energy asset owner, it’s the way to sell your production.

We produce the essential market insights necessary to create maximum value on your PPA. Our skills in forecasting day-ahead and intraday market prices combined with our deep understanding of meteorology allow us to spot arbitrage and trading opportunities, leading to increased profitability.

Forecasting, Shaping and Imbalance costs

A PPA has 3 main building blocks

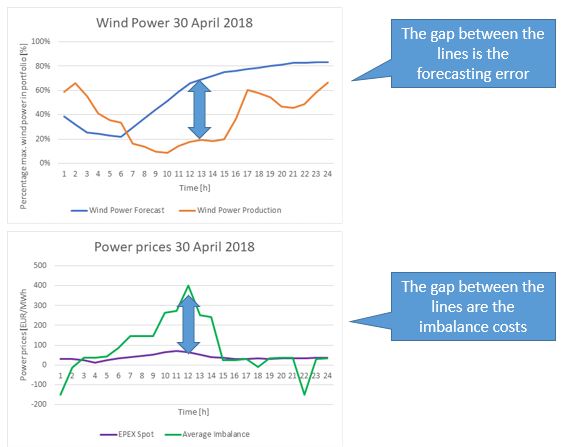

1. Forecasting

Priogen is proud to employ 7 highly specialised meteorologists that work with experienced traders who have a broad scope on the renewable energy market. Powered by proven analytics and state of the art pricing algorithms, our team is known to deliver the highest accuracy rates in the market. The more concise the production of a windmill park is forecasted, the more revenues it will generate. But you know what they say: the weather can change in a heartbeat.

Looking to invest your trust in a solid partner to manage risks and increase profits? Priogen has what it takes. We have the vision, dedication, skills and insights that enable unparallelled quality of forecasting.

2. Shaping

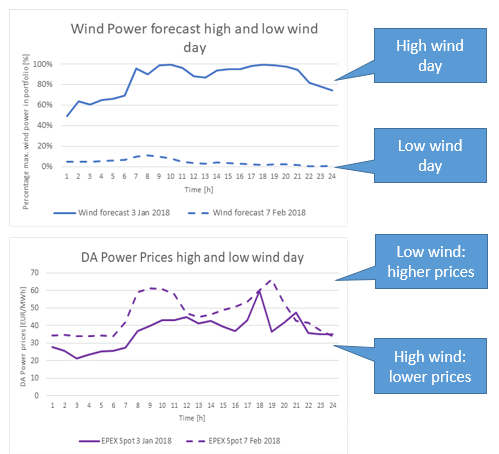

The production output of a renewable source is variable and volatile. This variable profile of production needs to be shaped into A) a tradeable wholesale product, like a base load. Or B) a consumption profile of an energy user. A renewable enery asset owner can also choose to sell his power as produced.

Industrial energy consumers can also go for a PPA from renewable sources of Priogen. But at a certain moment the power production or consumption needs to be shaped by someone to reduce the risks of forecasting, shaping and therefore also on the imbalance costs. These costs of imbalance can be severe and can only be mitigated by an accurate forecast and appropriate shaping of the production. Priogen positions itself as a risk-taker on all of the building blocks within a PPA.

Shaping is also necessary as transactions in the wholesale markets are done in hours. Whilst actual production of power is measured in a 15 minutes interval (PTUs or Programme Time Units). So tradeable hours also need to be shaped into PTUs and vice versa as no production or consumption profile is the same.

Shaping costs: prices are lower when there is lots of wind (as more supply leads to lower prices).

3. Imbalance costs

With physical power, you pay for not only the amount of electricity you used, but also the difference between what you forecasted you would use and what you actually consumed. Or in case of a renewable asset owner, there is a different market price for what you forecasted you would produce and what you would actually produce. It is the Transmission or Distribution System Operator or grid operator’s job to ensure grid stability, and he manages this imbalance for you, but then levies the total cost to balance the grid onto you and this is called the imbalance cost. These costs can be severe: prices ranging 200-500 EUR/WMh for imbalance are common. And with the increase of renewable power production the deltas of between the Day Ahead, Intraday and Imbalance markets will most likely be even higher in the foreseeable future. Therefore increasing the risk and costs for renewable power producers and offtakers.

The balancing market is used to ensure grid stability. It does so by matching the total electricity production and total demand. Reality is that industrial offtakers do not use as much electricity as they bought or produce as much electricity as they have sold. When there is a mismatch (which there is almost all the time) there is an imbalance, and total production needs to be increased or decreased to meet this imbalance. So the grid operator may tell certain producers to increase or decrease production by a certain amount in order to maintain the grid. These producers are receiving money for doing so. Once the delivery period is over and all possible balancing actions have been taken, the grid operator then calculates the imbalance price for that delivery period. This price is normally based on the costs the grid operator incurred in balancing the grid. This imbalance price is then paid by all the participants based on the difference between what they bought/sold and what they used/produced. The goal of this price is to incentivize participants to produce/use exactly what they said they would. Meaning that accurate forecasting is essential to reduce imbalance costs.

Imbalance costs: the inevitable forecasting errors lead to additional costs, as imbalance costs can be 10* normal prices. This means that one bad day of forecasting costs 10 days of revenues.